working in nyc living in pa taxes

Since he lived in NY for over 184 days he is considered a NY. Teacher health insurance works pretty much anywhere.

Best Neighborhoods For Singles In Nyc Cost Of Living Alone Streeteasy

Im paying taxes in nyc but dont live therThe taxes im talking about is state and local.

. You are a New York City resident if. Ecuapapu 3 min. The TP lived in New York City until he moved to PA on 08312020.

Your domicile is New York City. Residents of California Indiana Oregon and Virginia are exempt from paying income tax on wages earned in Arizona. On your PA return.

For one it boasts a low cost of living and a very low-income tax. In short youll have to file your taxes in both states if you live in NJ and work in NY. Taxes Pennsylvania 3 replies.

If you dont live in DC. This means for example a Pennsylvania resident working in one of those states must file a return in that state pay the tax and then take a credit on his or her Pennsylvania return. If you are still receiving income from NY then yes you are still liable for NY income tax.

This form calculates the City. You probably wont want to though. Youll be taxed by NY for your NY earned income at least NYC tax doesnt apply to non-residents so itll just be NY state taxes on your wages.

You will have topay taxes to NY and NJ though but its usually not much to NJ. Your domicile is New York City. Therefore a non-filing out of state corporation which continues to have a Pennsylvania resident working at home in 2021 after the End Date has nexus for 2021 and future years based solely.

Answer 1 of 6. NY will want you to figure the NY State income tax. I am working on a multi state tax return.

I work in new york but live in pa. I work in new york but live in pa. You pay state and federal taxes in the State of PA on total income.

You pay out of state income taxes to the State of NY on portion of income earned in New York imagine if. You have a permanent place of abode there and you spend 184 days or more in the city. I grew up in a small town in Pennsylvania essentially right on the border of New Jersey along the Delaware river.

Answer 1 of 11. I brought m y house in 2007 and in nys i payed for. Answer 1 of 11.

Like most US States both New York and New Jersey require that you pay State income taxes.

Find Local Tax Offices Professionals Near You H R Block Reg

Limited Liability Company Taxes Turbotax Tax Tips Videos

2447 Federal St Philadelphia Pa 19146 Redfin

1911 Green St 3 Philadelphia Pa 19130 Redfin

Can You Work In New York And Reside In Pa Quora

Pennsylvania Tax Rates Things To Know Credit Karma

Reciprocal Agreements By State What Is Tax Reciprocity

10 Most Affordable Places To Live In Pennsylvania

Additional Information About New York State Income Tax Refunds

States With The Largest And Smallest Tax Burdens

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

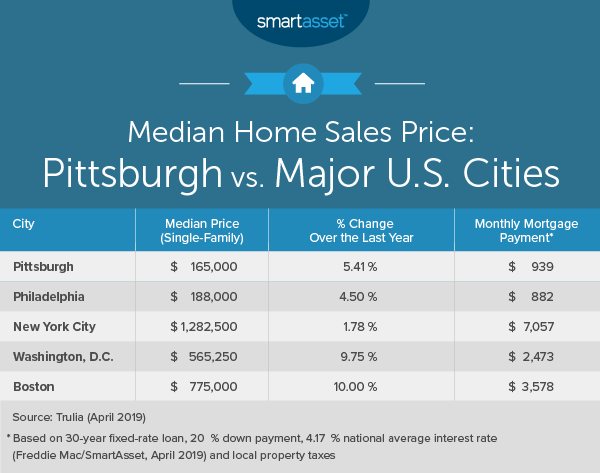

The Cost Of Living In Pittsburgh Smartasset

How 1 000 A Month In Guaranteed Income Is Helping N Y C Mothers The New York Times

How New York S Skewed Property Tax Benefits The Rich

2023 Best School Districts In Pennsylvania Niche

Affordable New York Apartments With A Catch The New York Times

The Most And Least Tax Friendly Major Cities In America

Is Moving To Pennsylvania Right For You A 2022 Guide Bellhop